Thinking of a career in Risk Management? Find all you need to know here about how to jumpstart your risk management career.

What is Risk Management

The Risk management profession has become more and more relevant in our world today as organisations seek to maximize profit in the face of greater challenges in the business environment. Risk, which is a measure of uncertainty in outcomes coupled with the impact of the outcomes, are always with us and an attempt to avoid all risks would result in no achievement, no progress and no reward. As such, the only alternative is to manage risks. This scenario presents huge opportunities for persons that have the relevant competencies in the business world.

All organisations have objectives at strategic, tactical and operational levels – anything that makes achieving these objectives uncertain is a risk. As our world becomes increasingly volatile and unpredictable, we must cope with greater uncertainty.

Risk management is the identification, assessment, and prioritization of risks (defined in ISO 31000 as the effect of uncertainty on objectives) followed by coordinated and economical application of resources to minimize, monitor, and control the probability and/or impact of unfortunate events or to maximize the realization of opportunities. Risk management’s objective is to assure uncertainty does not deviate the endeavor from the business goals.

Risk management is required across the entire enterprise to include financial, project, information technology, safety, health, etc

Who is the Risk Manager

The Risk Manager advises the organisations on any potential risks to the profitability or existence of the company. They identify and assess threats, put plans in place for if things go wrong and decide how to avoid, reduce or transfer risks. At times, the risk manager is focused on a specific area of risk e.g. financial or information technology. Some organisations however have an enterprise wide approach to Risk Management. The Risk Manager role is key to any organisation’s strategic plan

How can I become a Risk manager

Although this area of work is open to all graduates, a relevant degree in a number of subject areas as listed below can increase your chances, these include:

· risk management (actuarial science);

· finance or economics;

· science;

· statistics;

· engineering;

· law;

· management or business studies.

Graduates of risk management courses and courses with risk management content are sought after and targeted by recruiters of risk managers.

Membership of risk management associations coupled with relevant degrees can help with job prospects. Postgraduate qualifications are not essential but can be advantageous. A Masters in risk management is available at a number of universities and may be particularly relevant for those who have not completed a risk management-related degree.

Entry without a degree is possible, but it would usually entail a career path through an administrative role, working up to a risk assistant position and progressing to a risk manager role. Employers would expect A-levels or equivalent qualifications for entry through this route.

Graduates of less relevant subjects can also take the recognised International Certifications in Risk Management to give them an introduction to risk management and increase their chances of getting an entry-level position.

Candidates need to show evidence of the following:

· technical acumen;

· problem-solving and decision-making abilities;

· analytical skills and a good eye for detail;

· ability to cope under pressure;

· planning and organisation skills;

· negotiation skills and the ability to influence people;

· good communication and presentation skills;

· commercial awareness;

· numerical skills and the ability to evaluate costs;

· ability to understand broad business issues.

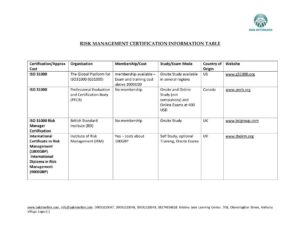

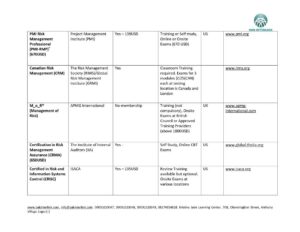

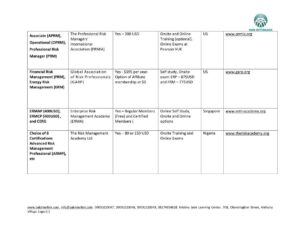

Certifications in Risk Management

There are a whole lot of associations promoting the risk management profession across the globe by offering association membership and certifications. Some are industry specific while some offer enterprise wide focused qualifications. Find a detailed analysis of some useful organization and their certifications below;